ARES Urbanexus Update #177

Residential

Brooklyn built 3,700 homes in six months

One New York City borough is building housing at a faster rate than others, with over 3,700 new units completed in the first half of 2025. Downtown Brooklyn, formerly dominated by offices, is now home to a growing number of homes.

According to a report from Crain’s New York, the 3,700+ new units include over 1,000 affordable units. As Emily Davis explains in a New York Post article, the neighborhood’s transformation mirrors that of Manhattan’s Financial District, which has shifted from a primarily commercial district to one with a significant residential component.

Since the neighborhood was rezoned in 2004, over 26,000 new housing units have been added. Residential foot traffic has increased by 97 percent since 2019, and new commercial developments are emerging around the neighborhood.

Learn more here.

Toll Brothers is exiting the “apartment living” business

Toll Brothers is getting out of the “apartment living” business, selling its vast portfolio of buildings to Kennedy Wilson for $347 million.

As reported by Builder Online, the deal brings $5 billion of assets under Kennedy Wilson management, including $2.2 billion in 18 apartment and student housing properties, and $3 billion of assets in 20 apartment and student housing properties Kennedy Wilson will manage for Toll Brothers.

Kennedy Wilson also gets 29 development sites, which, if completed, would total approximately $3.6 billion in capitalization.

Learn more here.

U.S. seniors rent like never before

Seniors are renting more than seniors did years ago: The most recent U.S. Census data reveals that, between 2013 and 2023, the number of renters aged 65 and over increased by 2.4 million — the largest growth of any age group, by far. And with record numbers turning 65, the shift not only echoes the broader aging of the nation, but also may signal a new approach to housing as more seniors enter the next chapter of their lives.

Point2Homes analyzed the 75 most populous U.S. metro areas and found that renting has become more common among older adults today than it was for people in the same age groups a decade ago.

Compared to 10 years ago, more seniors are stepping away from the burdens of homeownership (such as property taxes, repairs, and the complexities of downsizing) and, instead, using home equity or retirement savings to support alternative living arrangements. Some are moving closer to family, others are downsizing to cut costs, or renting simply to live on their own terms. Renting also provides flexibility for a growing number of older adults who remain in the workforce well into their 60s, allowing for job-related moves, seasonal living, or part-time relocation.

Learn more here.

Pay up or move out

A Bloomberg investigation has uncovered how a private equity firm, American Recovery Center (ARC), profits from “zombie” mortgage debt—old, often forgotten second mortgages that resurface years after homeowners believed they had been resolved. These debts, typically small and long dormant, are bought in bulk by ARC at steep discounts. The firm then aggressively pursues repayment, often through lawsuits, liens, or threats of foreclosure, even when the original debt has been discharged or is legally questionable.

This practice hinges on the concept of “zombie debt”: second mortgages that linger after a primary mortgage has been foreclosed or paid off. Many homeowners are unaware that these debts still exist, especially if they were never contacted during the original foreclosure process. Years later, ARC may initiate legal action, catching homeowners off guard and forcing them into costly settlements or court battles to protect their property.

Learn more here.

Divergent housing price trajectories in U.S. metropolitan areas

A Corner Side Yard Substack post by Pete Saunders draws upon a groundbreaking study by Lyons, Shertzer, Gray, and Agorastos—extended by the Washington Post’s Department of Data—that traces inflation-adjusted housing prices across 30 U.S. cities from 1890 to 2020 using over 2.7 million classified ads. The findings reveal a profound divergence in urban housing markets, particularly between Midwestern and coastal cities. Nationally, real housing prices remained flat from 1890 to 1940, with homeownership functioning more as a stable commodity than an appreciating asset.

However, post-1970—especially between 1997 and 2006—real capital gains in housing became significant, transforming homes into speculative investments in many regions. The study highlights a “J-curve” rise in housing prices in West Coast and Sun Belt cities (e.g., Los Angeles, San Francisco, San Diego), contrasted with an “inverted J” decline in Midwestern cities (e.g., Detroit, Cleveland, Pittsburgh). For instance, Detroit ranked first in housing prices in 1940 but fell to 26th by 1980, while Los Angeles rose from 25th to second. From 1940 to 2020, real housing prices rose by just 4% in Cleveland, but surged over 500% in several California metropolitan areas.

Learn more here.

Master-planned communities

California Forever’s pivot

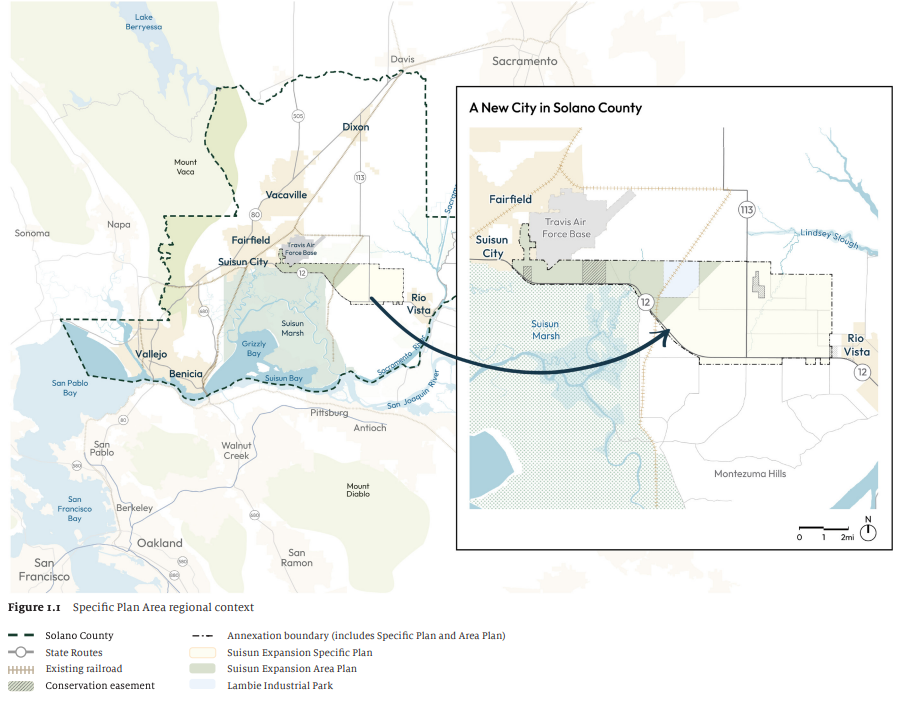

For five years, California Forever operated in near-total secrecy, quietly assembling over 60,000 acres of mostly marginal agricultural land in southeastern Solano County. By car, the center of the assemblage is located approximately 60 miles northeast of downtown San Francisco and 43 miles southwest of downtown Sacramento.

Location of California Forever

The effort remained opaque until August 25, 2023, when the New York Times revealed that a group of Silicon Valley billionaires—including Marc Andreessen, Reid Hoffman, and Laurene Powell Jobs—had quietly backed the acquisitions through a shell company called Flannery Associates. Days later, California Forever launched its public-facing website and unveiled its vision: a new walkable city for 400,000 residents and 200,000 jobs on the edge of the greater Bay Area.

In January 2024, the company submitted a countywide ballot initiative to amend Solano County’s general plan, allowing urban development on agricultural land. But after months of mounting opposition, California Forever withdrew the measure on July 22, 2024, opting instead to pursue a formal application and environmental review process through Suisun City. The project proponents submitted an annexation request and specific plan for 35.7 square miles on October 14, 2025.

Now, after an abandoned ballot initiative and a strategic pivot, there is much work to be done to turn this vision into reality.

Learn more here.

Financing mechanisms for the top 50 selling MPCs

RCLCO has teamed up with Launch Development Finance Advisors to investigate and found that a significant majority of home sales within the 50 top-selling master-planned communities occurred within communities using special-purpose taxing districts. In addition, Launch and RCLCO have calculated the estimated net proceeds for a sample home in the Top-50 MPCs using average prices.

Most top-selling master-planned communities (MPCs) in the country utilize some form of special financing district in their development. In fact, 88% of home sales in RCLCO’s Top-50 MPCs at Mid-Year 2025 occurred within a special taxing district.

A sampling of homes among the Top-50 MPCs in the country indicated an average annual district tax payment of $3,422 among MPCs that had a financing district in place. This translates to an annual homeowner cost of 0.7% of average home values, or just over $285 per month.

Learn more here.

Community development at Lakewood Ranch

Lakewood Ranch near Sarasota, FL, has held a top spot among multigenerational master-planned communities in the United States since 2018. Patient capital and a long-term vision have allowed Lakewood Ranch to command premiums of 35 percent to 40 percent above comparable homes in the region. Now, 31 years into its development cycle, the Florida community continues to attract buyers across all life stages while remaining true to its original principles.

Laura Cole, Senior Vice President at Lakewood Ranch, believes consistency in stewardship matters more than any single amenity in ensuring the long-term viability of a master-planned community. The firm created a financial instrument called the Stewardship District, which enables long-term planning by shifting the burden of growth and costs to individuals moving to the area.

The Stewardship District enables the developer to view the community as a holistic system rather than as a collection of incremental pieces. It also covers operations and maintenance so that when development is complete, community maintenance is funded and quality is maintained over time.

Learn more here.

Mixed-use

Legacy Park in Mesa, AZ

Vestar, a shopping center and mixed-use developer based in Phoenix, has partnered with Pacific Proving LLC to develop a $2 billion mixed-use neighborhood. Named Legacy Park, the project will span 200 acres at Pacific Proving Ground’s 1,805-acre property in Mesa, near the confluence of the communities of Gilbert and Queen Creek. The groundbreaking is set for 2027.

Vestar expects Legacy Park to generate $56 billion in economic output over the next 20 years and to create more than 20,000 jobs. At build-out, the project is designed to include:

300,000 square feet of upscale retail and restaurant space that will house chef-driven, fine dining, and innovative food-and-beverage concepts

2,500 multifamily residences

A 600-room resort hotel to be developed by The Athens Group

3.4 million square feet of mid-rise office and corporate campus space

A 20-acre urban park, including a large lake that will serve as a regional gathering space for recreation, events, and community connection

The size and design of Legacy Park’s retail component will be comparable to Scottsdale Quarter, in which Vestar is a partner.

Vestar’s portfolio exceeds 30 million square feet across the Western United States, with an additional 3 million square feet under active development.

Learn more here.

Office

Are you returning to the office?

Peter Coy offers a perspective on the return-to-office impetus coming from corporate leadership. He notes that many employers seem to want to return to 2019, when only about 7 percent of full-time paid days were worked from home. Maybe you work for one of them.

The arguments in favor of face-to-face interactions include increased bonding and more serendipitous encounters. However, Coy opines that it’s unclear why the current balance is so unfavorable. He suggests that a combination of RTO (return-to-office) and WFH (work-from-home) might be the solution.

Learn more here.

Downtown Los Angeles office tower goes into receivership

One California Plaza — the gleaming 42-story tower on Bunker Hill that was one of the most prestigious addresses in the city when it opened in the 1980s — has dropped 74% in value from its market peak.

Earlier in 2025, the owners defaulted on their $ 300 million debt, set to mature in November, and faced foreclosure. The property is appraised at $121.2 million, down significantly from $459 million in 2013, according to a Morningstar Credit report.

Net cash flow at the property trailed expectations by 37% in 2024, and the building is now 62% leased after the departure of major tenants, including law firm Skadden, Arps, Slate, Meagher & Flom, which is set to relocate to Century City.

Learn more here.

Industrial

Data centers are essential

Peter Samuel notes that many people who attend meetings and comment on data centers assume they are optional — that we can do without them. However, modern life relies heavily on data centers. Communications, news, education, entertainment, advertising, weather forecasts, and the purchasing of most goods and services are almost all online now. And what’s left on paper or in person is steadily going online too.

People complain about the amount of water data centers use and their significant electricity consumption. But banishing data processing to neighboring areas or states won’t reduce water usage for data processing by a single gallon or energy usage by a kilowatt-second.

Learn more here.

Retail

New retail leaders face extra headaches

Chief executives must know how to simultaneously satisfy the needs of their boards of directors, employees, and customers. And they are well compensated for this. They earn more than $1 million in base salary, along with bonuses and stock options valued in the millions. Those taking the top job for the first time must address new problems for which there’s often no playbook. They have to do this while fixing the ones that led the company to find a new leader in the first place.

That may be why CEO turnover is high in the consumer sector: It accounted for a quarter of all chief executive turnover across corporate America, according to a recent report by Crist|Kolder Associates, an executive search firm. The average tenure for a chief executive in consumer businesses was 5.9 years, a slight decrease from last year. That’s among the shortest in American business. At tech firms, for instance, the average was 10 years. In the financial services sector, the average tenure was 8.7 years.

Learn more here.

Hospitality

San Francisco Bay Area resort faces $230 million foreclosure

An opulent Bay Area resort that promises “enriched bucolic living” is facing foreclosure on a nearly quarter-billion-dollar loan. According to the Napa Valley Register, the owners of Napa’s Stanly Ranch retreat were notified on Oct. 16 that the property had defaulted on its loan. The outstanding loan balance totals $230,366,192, and if the debt remains unpaid, Stanly Ranch may be subject to auction.

Opened in April 2022, the property is among the region’s newest luxury lodging options. Earlier this year, it was awarded one Michelin key, a designation for a hotel that provides “much more than others in its price range” and where “service always goes the extra mile.” Nightly rates start at around $700.

Encompassing a sprawling 712 acres, Stanly Ranch features 135 cottages and suites, vineyards, pools, a spa, an on-site restaurant, and 110 permanent residences. One of these homes fetched an all-time high sale in June of this year for $9.1 million, according to Forbes.

Auberge Resorts, a high-end hotel chain with locations worldwide, operates Stanley Ranch. Founded in Napa Valley in 1981, its first hotel was the three-Michelin-starred Auberge du Soleil, a 20-minute drive north on Highway 29 in Rutherford.

Learn more here.

Real estate finance

Banking on bigness

Coby Lefkowitz offers some perspective on the financing challenges facing smaller, emerging developers of real estate.

Historically, America’s neighborhoods were often constructed by small builders. These were necessarily local firms that could take a few lots and imbue them with the local character and styles (known as vernacular). Over time, these layers gave a city soul and identity.

Today, those same builders are being locked out of the process before they can even break ground due to numerous reasons, including: banks demanding track records small developers can’t possibly have, regulations built for billion-dollar institutions that smother smaller community lenders, and the fact that most capital has consolidated into a few institutional hands who can only really back projects of massive scale.

The result? Fewer of the types of places that lend an intimate identity, and more anonymous boxes. If we want communities with life, character, and soul, Lefkowitz believes we must reform how they’re financed.

Learn more here.

Artificial intelligence

Fake images, videos, and recordings

Not long ago, real estate scams typically involved forged deeds, stolen identities, or shady shell companies. The scams were relatively crude and usually relied on old-school trickery. Now? The game has changed in ways few people could have predicted even five years ago.

In today’s market, real estate fraud isn’t just a matter of forged signatures or phony wire instructions. It’s about impersonation on a scale — and with a realism — that was once the stuff of science fiction. We’re talking about deepfakes: computer-generated images, videos, and voices that mimic real people so well that even seasoned professionals can’t always tell the difference.

In one case reported by CNN, a finance worker at a multinational firm was tricked into paying out $25 million to fraudsters after receiving what seemed to be a routine video call from his company’s chief financial officer. The only problem? The CFO wasn’t real. The voice and face were fakes — deepfakes, in fact. Created using publicly available images and voice samples, the fraud was so sophisticated that it fooled everyone involved.

Learn more here.