As of December 2012, the United States was three and a half years into a recovery from its worst economic downturn since the Great Depression. Yet many retail centers continue to experience difficulty attracting sustainable tenancies and we are seeing more and more vacant big box stores (RREEF - 2012). The reason is that, overall, we have more retail space than we can sustain.

A look at the change in shopping center space statistics over the past several decades shows that we have been on a building binge. As of the mid 1980s, we had approximately 15 square feet GLA (gross leasable area) of formal shopping center space per capita (Serwer 2003). Since then, shopping center space (which accounts for about half of all retail space), has expanded four times faster than population growth. By 2010, we had about 24 square feet of shopping center space for every man, woman and child in the United States (McKinsey - 2010)!

As of December 2012, the United States was three and a half years into a recovery from its worst economic downturn since the Great Depression. Yet many retail centers continue to experience difficulty attracting sustainable tenancies and we are seeing more and more vacant big box stores (RREEF - 2012). The reason is that, overall, we have more retail space than we can sustain.

A look at the change in shopping center space statistics over the past several decades shows that we have been on a building binge. As of the mid 1980s, we had approximately 15 square feet GLA (gross leasable area) of formal shopping center space per capita (Serwer 2003). Since then, shopping center space (which accounts for about half of all retail space), has expanded four times faster than population growth. By 2010, we had about 24 square feet of shopping center space for every man, woman and child in the United States (McKinsey - 2010)!

A strengthening economy is unlikely to absorb all of the excess shopping center space. In fact, overall demand for retail stores is likely to shrink in coming years due to several factors:

- slower growth in household incomes

- a higher propensity to save due to continuing uncertainties about housing values and adequacy of retirement funding

- migration of some retail sales to the Internet.

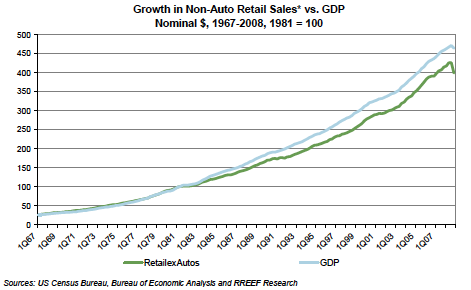

Several years ago, analysts at RREEF pointed out that even during the massive expansion of shopping centers between the early 1980s and the onset of the Great Recession, retail spending generally grew more slowly than gross domestic product (GDP) (RREEF 2009).

Perhaps even more significant, retail spending has not been the major factor in the growth of the consumer sector. As the RREEF analysts point out, retail’s share of consumer outlays actually peaked more than sixty years ago--shortly after the end of World War II. We tend to forget that the consumer sector also includes items such as rent, medical care and travel. And the largest consumer growth category has been healthcare, which increased from only 3% in 1945 to almost 18% of household expenditures in 2008 (RREEF 2009. p. 4). So far, there is no evidence that this long-term rise in healthcare expenditures will abate.

More than any other factor, population growth will support the absorption of space in retail centers. As of 2012, the US Bureau of the Census bureau forecast the population of the United States to grow from about 315 million at the beginning of 2013 to 400 million in 2051—an increase of 33% over this 48-year period (U.S. Bureau of the Census 2012). If we added no more shopping center space, this population growth would bring the amount space down to a more sustainable ratio—about 17 square feet per capita—two square feet above where we were as of the mid 1980s.

But not all regions of the nation will grow equally. And the regions that have grown most rapidly tend to be those that have seen outsized growth in retail space. The simple fact is that under any economic and demographic scenario we have more shopping center space than we need.

References

- McKinsey and Company (2010). The Next Wave of M&A in US Retail. New York, NY: Mauricio Jaramillo, Ian MacKenzie, Chris Meyer, Steve Noble, Todd Yost. Retrieved from http://www.mckinsey.com/Search.aspx?q=next%20wave%20of%20m%20a%20in%20us%20retail

- RREEF (2009). Done Shopping – Structural Shifts in the US Retail Sector and Their Implications for Real Estate Investment. San Francisco, CA: Andrew J. Nelson, Alex Symes. Retrieved from http://www.squarefeetblog.com/commericialrealestateblog/2009/06/10/done-shopping-rreff-on-retail-real-estate-investing/

- RREEF (2012). E-Commerce and Retail Property Markets: (When) Should We Panic? San Francisco, CA: Andrew J. Nelson. Retrieved from http://www.rreef.com/content/_media/Research_RREEF_Real_Estate_Bricks_and_Clicks_July2012.pdf

- Serwer, Andy (2003). The Malling of America Unabated—And Frenzied Growth in Retail Space is a Trend That Might End Badly. Fortune Magazine. Retrieved from http://money.cnn.com/magazines/fortune/fortune_archive/2003/10/13/350907/index.htm

- U.S. Bureau of the Census. (2012). U.S. Census Bureau Projections Show a Slower Growing , Older, More Diverse Nation a Half Century from Now. Washington, DC: US Bureau of the Census. Retrieved from http://www.census.gov/newsroom/releases/archives/population/cb12-243.html