ARES Urbanexus Update #176

Residential

The missing multifamily middle

The missing middle construction sector encompasses the development of medium-density housing, including townhouses, duplexes, and other small multifamily properties.

The multifamily segment of the missing middle (apartments in 2- to 4-unit properties) has generally disappointed since the Great Recession. For the second quarter of 2025, there were 5,000 2- to 4-unit housing construction starts. This represents a small increase relative to the second quarter of 2024.

Over the last four quarters, this type of construction totaled 21,000 units, representing a 50% increase over the four quarters preceding that period (14,000 units).

As a share of all multifamily production, 2- to 4-unit development was just 4% of total multifamily development for the second quarter. This remains lower than recent historic trends. Between 2000 and 2010, such home construction accounted for approximately 11% of total multifamily construction.

The construction of the missing middle has clearly lagged during the post-Great Recession period and is likely to continue doing so without zoning reform focused on light-touch density. However, recent modest gains offer some hope for increasing the housing supply for these types of homes.

Housing shortages hit low-income renters the hardest

While rent is stabilizing in high-growth cities, low-income renters are being priced out of housing-constrained metros.

Rents are surging, and residents are being displaced in cities with limited housing development, a Pew analysis shows. From 2017 to 2024, rents in the lowest-income ZIP codes had the highest rent increases — as much as 10.3%, according to Pew.

A 10% increase in a ZIP code’s housing supply correlated with slower rent growth — an average of 1.4% less compared with a ZIP code with no increase in its housing supply, according to a Pew analysis of Zillow data from 2017–2023. The biggest rent declines in metros that have boosted housing supply were in low-income areas.

“Maintaining restrictive zoning that exacerbates the housing shortage puts vulnerable tenants in a more precarious position by burdening them with steep rent increases,” the Pew analysis states. “Allowing enough homes for everyone improves affordability overall, but the evidence shows it benefits low-income renters most.”

Learn more here.

Regulatory reform in California

The California Legislature has rolled back provisions of the California Environmental Quality Act (CEQA) to spur housing construction and cut red tape for other types of projects, according to a June 30, 2025, news release from Gov. Gavin Newsom, who signed the legislation the same day.

The rollbacks, which were implemented as part of the state’s 2025-2026 budget and are now in effect, will exempt certain types of projects from the environmental reviews required under the CEQA.

The CEQA (say “See-Kwǎ”), which was signed into law in 1970 by then-Gov. Ronald Reagan is commonly referred to as a landmark piece of environmental legislation. It required state and local governments to study and publicize what it considered likely impacts to the environment around projects.

It was well-intentioned legislation that turned into a monster, a tool for blocking development and a significant cause of California’s high rate of homelessness. It remains to be seen how effective the new legislation will be in unlocking new construction:

Citizens and environmental groups opposed to new housing development have historically been highly creative in finding ways to block it. But what Newsom has achieved what seemed politically impossible not long ago. Because of the rollbacks, housing developers won’t face the ongoing threat of open litigation that has been the norm in the state under the rule, CalMatters reported.

Learn more here.

The top ten builders share in the USA rose again in 2024

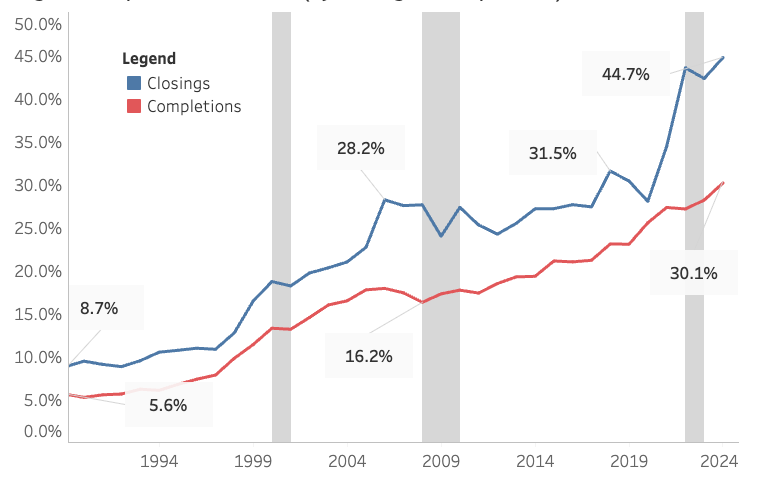

The top ten builders captured a record 44.7% of all new U.S. single-family home closings in 2024, up 2.4 percentage points from 2023 (42.3%). This is the highest share ever captured by the top ten builders since Nathional Association of Homebuilders (NAHB) began tracking BUILDER magazine data on new single-family home closings in 1989.

The 2024 share constitutes 306,932 closings out of 686,000 new single-family houses sold in 2024. However, closings by the top 10 builders account for only 30.1% of new single-family home completions, a broader measure of home building that encompasses not-for-sale home construction. Also notable is that the top 15 builders accounted for more than half of all closings (51%) for the first time in 2024.

The top ten builder share has increased significantly – albeit unevenly – in the last 35 years. In 1989, the top ten builders accounted for only 8.7% of single-family home closings. By 2000, the share had more than doubled to 18.7%, growing to 28.2% by 2006 and 31.5% by 2018. After slight declines in 2019 and 2020, the share exceeded 40% for the first time in 2022 (43.5%) and reached a record high in 2024 (44.7%).

Meanwhile, the top ten builders share by completions has also trended upward, with a share of just 5.6% in 1989. It reached double digits for the first time in 1999 (11.3%) and rose to a cycle high of 17.9% in 2006. The share broke the 20% mark for the first time in 2015 (21.0%) and has continued to trend upward since, reaching an all-time high of 30.1% in 2024

Top 10 Builder Share (by Closings and Completions)

Master-planned communities

California Forever

California Forever’s East Solano Plan would create a city of up to 400,000 people on portions of approximately 69,000 acres of Northern California ranchland in the San Francisco Bay Area. The project, funded by Bay Area tech moguls, envisions a new downtown with traditional walkable neighborhoods and a significant employment center. It gained national attention in August 2023, after The New York Times unveiled the mysterious group quietly acquiring large tracts of land.

After tepid public support, the project’s backers pulled a November 2024 ballot measure. They haven’t given up, but instead have agreed to work with the local government agencies to secure rezoning via standard environmental review and land use entitlement and annexation processes.

California Forever has revised and reprioritized its plans for the proposed master-planned development located approximately 55 miles northeast of San Francisco and 40 miles southwest of downtown Sacramento.

Learn more here.

RCLCO’s mid-year update

Every year since 1994, the real estate advisory firm RCLCO has conducted a national survey identifying top-selling master-planned communities (MPCs) through a rigorous search for high-performing communities in each state. This initiative, now in its 32nd consecutive year, not only recognizes the most successful communities in the USA but is also a tool for monitoring the overall health of the for-sale housing industry and highlighting the trends affecting communities large and small.

In summary:

New home sales among the 50 Top-Selling Master-Planned Communities were down 6.6% at the end of June compared to the pace set by top communities in the first half of 2024.

Economic uncertainty, weak consumer sentiment, and continued affordability challenges are contributing to a cooling new home market.

The broader new home market experienced a similar decline, with sales of new single-family houses in the United States at a seasonally-adjusted annual rate of 627,000 in June, representing a 6.6% decline from June 2024.

Top-selling master-planned communities continue to capture more sales as a percentage of the new home market during slower sales periods.

Learn more here.

Office

Vacancy rates in the USA

The U.S. office vacancy rate was 20.6% in Q2 of 2025, according to Moody's Analytics' preliminary data for the quarter. It's the sixth time a new vacancy record has been set in the post-pandemic office market, and it could continue to tick higher this year as longer leases predating 2020 expire. Companies continue to prioritize smaller, highly amenitized office real estate.

Leasing activity also dampened somewhat in Q2, with positive net absorption recorded in only a couple of markets tracked by Moody's. Dallas saw 1.3 million square feet of net absorption last quarter — the most of any market by a large margin. Orange County, California, was at No. 2, with 380,000 square feet of net absorption.

Meanwhile, 11 office markets tracked by Moody's posted negative net absorption in Q2. Four markets — Seattle, Boston, Chicago, and suburban Virginia — had negative net absorption in excess of 500,000 square feet.

In the first half of 2025, U.S. office leasing activity totaled 138 million square feet — 14.8% below the pre-pandemic H1 average of 162 million square feet (between 2000 and 2019) and 13.8% below the first half of 2024, according to Avison Young data.

Learn more here.

Office visit gaps close

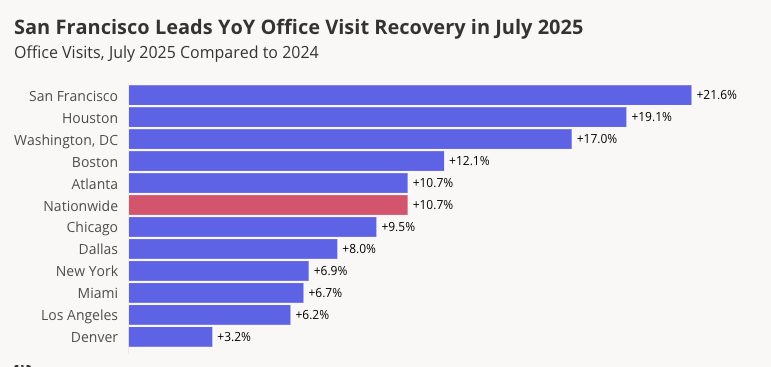

The Placer.ai Nationwide Office Building Index shows that in July 2025, office visits were were down just 21.8% compared to July 2019 – and up 10.7% compared to July 2024. And longtime office recovery leaders, Miami and New York, effectively closed their post-pandemic office visit gaps in July 2025. New York City’s office visits rose 1.3% above July 2019 levels, while Miami’s visits were just 0.1% below.

Learn more here.

Source: Placer.ai

Source: Placer.ai

Source: Placer.ai

Retail

Grocery store changes in the San Francisco Bay Area

The aisles in the Safeway grocery store in the East Bay community of El Cerrito were formerly separated into two rows, with a gap in between for shopping cart passage. That all changed with the pandemic, when store workers consolidated the shelves, extending them from the checkout stands to the pharmacy in the back.

Safeway and other major retailers are adapting to an era of e-commerce, with a significant portion of their customer base now ordering groceries through an app and having them delivered to their homes. They promote their apps for online shopping and delivery, although third-party platforms are also gaining popularity. Instacart, the app that began steering shoppers online more than a decade ago, reported 83.2 million orders throughout North America in the first quarter of 2025 — up 14% year-over-year.

As technology becomes more pervasive, it has begun to alter the appearance and overall ambiance of the large chain grocers where people traditionally made their weekly shopping trips. Some have undergone such dramatic transformations that they’ve come to resemble distribution centers.

While shoppers may complain that super-stretched aisles are harder to navigate, the setup appears to make it easier for “pickers” — employees who push carts down the aisles, grabbing items for customers who’ve ordered online. In another sign of the trend, many big box stores now keep fewer cashier stands open, encouraging shoppers to either use self-checkout or do their bulk shopping through an app.

Once considered an essential staple of any thriving neighborhood, the American big box grocery store may be crumbling, felled by the same forces that closed shopping malls and turned so many sit-down restaurants into takeout stands. The next phase for urban supermarkets, according to Stanford University economics professor Nicholas Bloom, is that they become “ghost stores”: vast storage facilities that exist only to support e-commerce.

Learn more here.

Resort/recreational communities

Twenty years of Seabrook

Modeled after Seaside, FL, a transcendent vision on the Pacific coast in Washington State that began serendipitously two decades ago has evolved into a residency of romanticized homes in the meticulously planned community of Seabrook. On the 20th anniversary of moving in as residents No. 1, founders and dreamers Casey and Laura Roloff claim that Seabrook provides a template for more accessible, livable, and affordable communities, a generation ahead of copycat subdivisions.

The seaside village sparks an existential debate over how to manage a ballooning population that needs a place to live, as summarized by Professor Yonn Dierwechter of the University of Washington’s Urban Studies Program. “On the one hand, New Urbanism provides coherence, thoughtfulness, and deliberateness,” he says. “On the other hand, part of what makes communities interesting and spontaneous and innovative is the collision of unexpected differences.”

Begun in 2005, Casey Roloff says people expected it to be a massive failure. With local contractors circling like hungry coyotes, predictions almost came true. The Roloffs say they lost $2.1 million on the first 17 houses due to unscrupulous contractors and miscalculated costs. Instead of walking away, they regrouped. The Roloffs found trustworthy engineers and contractors, recalculated building costs, and produced what few thought possible: a Washington resort beach town.

Seabrook has sold over $700 million in real estate since its inception. Newly constructed houses start around $1 million and increase from there. One-bedroom bungalows go for $500,000. Half the 600 current homes are vacation rentals; another 200 serve as pied-à-terres for absentee owners.

Learn more here.

Urban design

Research on new urbanism

Practitioners of the new urbanism – otherwise known as walkable, compact, mixed-use, multi-modal urbanism of the kind that is more common in traditional cities and towns – have been criticized for making ideological pronouncements without a solid foundation of evidence.

A research project at the University of Notre Dame has shown just how compelling that big picture can be. The project has developed a database of over 200 representative research papers from across a wide range of disciplines, with findings on many different impacts of urban form. The goal has been to bring together, for perhaps the first time, research findings from medicine, economics, law, psychology, sociology, ecology, engineering, and other fields, to paint a larger picture of the successes – and the remaining challenges for the practice of New Urbanism, and related reform movements.

The project has been part of the Housing and Community Regeneration Initiative at the University’s School of Architecture, led by Marianne Cusato, with direction from Dean Stefanos Polyzoides, and contributions from Senior Researchers David Brain and Jim Brainard, both part of the HCRI initiative. Jim Brainard is the long-time mayor of Carmel, Indiana, an award-winning exemplar of a suburban transformation into a national model of livability. David Brain is a long-time member of the Congress for the New Urbanism and a noted sociologist. Dean Stefanos Polyzoides is a co-founder of the Congress for the New Urbanism. This author led the research and database curation process.

Among the more striking findings:

New urbanist development can save an average of 38 percent on upfront costs for new construction of roads, sewers, water lines and other infrastructure, generate 10 times more tax revenue per acre than conventional suburban development, and can reduce the costs of ongoing delivery of public services including police, ambulance and fire by an average of 10 percent.

New urbanist development can reduce trip generation and parking demand by over half.

Homes in New Urbanist neighborhoods can command price premiums of 14.9 percent over comparable properties

Streets in new urbanist neighborhoods are measurably safer than sprawling suburbs due to lower vehicle speeds and pedestrian-friendly street designs.

Residents of new urbanist neighborhoods are approximately 50 percent more likely to achieve recommended levels of physical activity compared to those in less walkable areas. Additionally, they are about 24 percent less likely to experience obesity, all other factors being equal.

A 5 percent increase in walkable infrastructure was found to lead to a 32.1 percent increase in time spent walking and a 6.5 percent reduction in vehicle miles traveled.

Residents of new urbanist neighborhoods report significantly and measurably higher levels of social trust and civic engagement than those in car-dependent suburbs.

Older adults living in walkable new urbanist areas experience lower rates of depression, stress-related illnesses, and dementia.

Traditional walkable and mixed-use development of the kind that is typical in new urbanist neighborhoods can reduce greenhouse gas emissions and air pollutants by 30 percent or more, all other things held equal.

Learn more here.

Redevelopment

Replacing excess parking

Most people driving by the Wheatland Plaza Shopping Center in Duncanville, Texas, would see nothing out of the ordinary: a shopping strip mall with about a dozen shops and 80 parking spaces. But when Monte Anderson, the incremental real estate developer leading Options Real Estate, considered the same strip mall four years ago, he saw something else: not just the potential to revitalize the shopping center but the opportunity to turn some of the parking lot into housing.

The United States currently facilitates the storage of about 200 million cars on somewhere between 700 million and 2 billion parking spaces nationwide, an allocation of land that the late parking expert Donald Shoup estimated cost the U.S. between $102-374 billion annually, about $221-652 billion in today’s dollars. Parking Reform Network’s analysis of parking-related land use in over 100 cities reveals that a median of 26% of the land in more than 100 city centers is reserved for parking, with some cities reserving well over 30% for car storage.

From a fiscal perspective, the Wheatland Plaza project is a plus: adding residential in lieu of the access parking would increase the economic productivity of the lot. This would benefit the city through increased tax revenues.

Socially, reusing parking for more dynamic, productive uses would add dynamism and activity to otherwise dead slabs of cement, while enabling people to live closer to jobs and forgo the expensive ownership of a car (or a second car) if they desire.

Learn more here.

Increased property value after redevelopment will generate additional property tax revenue.

Regional and metropolitan trends

AI readiness across the USA

Artificial intelligence is already transforming the nation’s economy, but similar to past emerging digital industries, its talent and activity are clustering in the Bay Area and a short list of other large, mostly coastal tech hubs. To assess the geography of the AI economy and promote its spread to more and diverse locations, a Brookings Institution report benchmarks 387 U.S. metro areas on their readiness to benefit from AI. Then it outlines a policy agenda to help regions maximize the technology's benefits based on their individual starting points.

To address these issues, the report maps the unfolding AI revolution across 387 U.S. metropolitan areas. It assesses how the nation and local economies are positioned to create, apply, and harness AI. The report first highlights the implications of AI for national and regional economic development. It then proceeds to a benchmarking exercise that categorizes 14 indicators into three dimensions of regional AI readiness: talent, innovation, and adoption.

Learn more here.

Relocation preferences

New York, Los Angeles, and Miami emerged as the top choices in an open-ended survey asking Americans where in the U.S. they'd most like to live. The results show how Americans perceive different cities, with some intriguing differences when people are asked about where they want to live versus where the best job opportunities are.

The findings are from the 2025 America's Best Cities report by Resonance, a marketing and branding firm for cities and destinations. As part of that report, Resonance worked with Ipsos to ask about 2,000 respondents nationwide to name the top three U.S. towns or cities they'd most like to live in someday.

After the top three came San Diego in fourth, Chicago in fifth and Las Vegas in sixth. Seattle, Boston, San Francisco and Phoenix round out the top 10.

Resonance also asked about places where people saw the best job opportunities, with some notable divergence from where people want to live. For example, Miami and San Diego both ranked highly as places where people want to live, but didn't even crack the top 10 for cities where Americans think the jobs are. Dallas ranked third in economic opportunities but 12th in desirability as a place to live.

Learn more here.

Resilience and sustainability

Embodied carbon pathways for the USA

Embodied Carbon Pathways to 2050 for the United States, a collaboration between the Carbon Leadership Forum (CLF), RMI, and the University of Washington (UW) Life Cycle Lab, provides an assessment of embodied carbon from US construction materials and explores pathways to align with a 1.5°C global warming limit.

The United States needs a 50% reduction by 2030 to align with a 1.5°C goal (Rhodium Group, 2023) and is not on track to meet this target. Rapid decarbonization of the US industrial and building sectors through energy efficiency, electrification, low-carbon material use, and material-efficient design is crucial to closing the emissions gap and preserving a livable climate. With limited time to act to avoid the worst consequences of climate change and increasing federal headwinds, focusing efforts on the highest potential strategies and associated policies is critical.

Six modeled pathways evaluate the potential of strategies and policies to close the gap between business as usual and 1.5°C-aligned trajectories. Only the “Best Case” scenario— combining aggressive adoption of all best practices and rapid development and deployment of emerging technologies—approaches the necessary reductions by 2050. Scenarios focused on design innovation and energy strategies also showed substantial promise.

Learn more here.

Around the world

Evergrande no longer grand

The moment passed without fanfare. China Evergrande, a real estate developer that once represented the pinnacle of China’s economic prowess, was formally removed from the Hong Kong Stock Exchange on August 18, 2025.

Evergrande, which made its financial debut in Hong Kong 16 years ago, had once been the fastest-growing property developer in a country brimming with promise of profits for investors. It will be remembered as one of the world’s most indebted companies whose collapse brought China’s financial system to the brink.

The company tested Beijing's long-standing “too big to fail” policy toward its largest companies. It shattered its tolerance of unchecked borrowing by giant corporations. And Evergrande’s collapse in 2021, under more than $300 billion of debt, exposed the vulnerabilities of China’s economy and its dependence on real estate as a driver of growth.

Now what’s left is the carcass of a corporate behemoth — 1,300 not-yet-finished real estate projects in more than 280 cities and hundreds of thousands of home buyers still waiting for their apartments. Then there’s the long line of creditors, from businesses in China that worked for Evergrande to investors in London and New York who bet on it, still waiting to be repaid.

Last year, a Hong Kong judge ordered Evergrande to be dismantled. She appointed Alvarez & Marsal, a firm specializing in bankruptcies that had previously helped unwind Lehman Brothers, to undertake the task. A year and a half into the job, the liquidators, two executives at Alvarez & Marsal, have made small steps toward helping overseas creditors get tiny slices of what they are due.

Learn more here.