Where investors own larger shares of single-family homes in the USA

The geography of single‑family homeownership in the United States has shifted dramatically over the past decade. While institutional investors often dominate headlines, the full picture is more nuanced. New data from the AEI Housing Center and Parcl Labs shows that the highest concentrations of non‑resident ownership are found in a cluster of fast‑growing Sunbelt metropolitan areas. These markets experienced large volumes of post‑foreclosure inventory, rapid population growth, and strong rental demand—conditions that enabled investors of all sizes to scale up.

The AEI/Parcl dataset is one of the few sources that measures investor activity as a share of the entire single‑family housing stock, not just rentals. This allows for a clearer understanding of how much of each metro’s housing supply is held by institutional, mid‑tier, and small‑scale owners.

Metropolitan areas with the highest investor ownership

Across the country, only a handful of metropolitan areas show non‑resident ownership levels above 20 percent of all single‑family homes. These metros are concentrated in the Southeast and Southwest, where investor activity surged after the Great Recession and continued through the 2020–2022 housing boom.

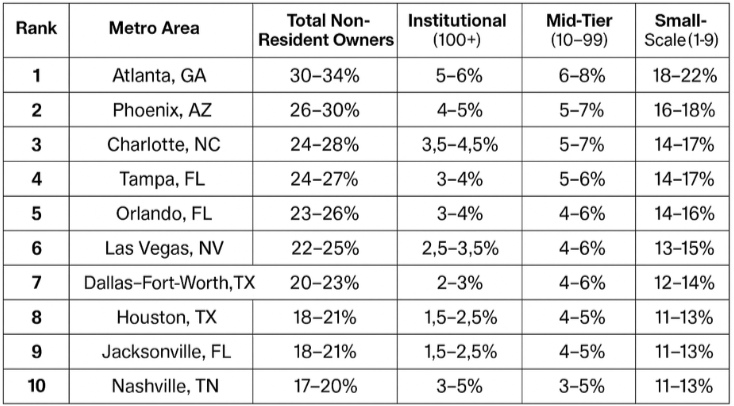

The table below summarizes the ten metros with the highest overall non‑resident ownership, broken out by investor size. All figures represent the share of the total single‑family housing stock.

Make it stand out

Whatever it is, the way you tell your story online can make all the difference.

What the Numbers Reveal

Three patterns stand out.

First, small‑scale investors remain the dominant form of non‑resident ownership. Even in the most institutionalized metros, small‑scale owners hold three to five times as many homes as large‑scale operators. This runs counter to the popular narrative that institutional investors are the primary force reshaping single‑family housing markets.

Second, institutional ownership is geographically concentrated. Only a few metros—Atlanta, Phoenix, Charlotte, Tampa, and Orlando—show institutional shares above three percent of the total single‑family stock. In most U.S. metros, institutional ownership remains below one percent.

Third, mid‑tier investors form a quiet but significant middle layer. These owners, with portfolios of 10 to 99 homes, consistently hold four to eight percent of the stock in high‑investor metros. Their role is often overlooked but increasingly important.

Why These Metros?

The metros with the highest non‑resident ownership share several structural characteristics:

Large inventories of similar, newer homes suitable for scaled management

High levels of post‑foreclosure distress after 2008

Strong population and job growth

Relatively permissive land‑use environments

High demand for single‑family rentals among new residents and priced‑out buyers

These factors created conditions where investors—large and small—could acquire and operate homes efficiently.

Sources

AEI Housing Center – Single‑Family Rental and Investor Share Dataset

https://www.aei.org/housing/single-family-rental-and-investor-share-dataset/